Introducing Snapchat Money for Snapchat India

Too long; didn’t read.

This is a case study of designing an MVF (Minimal Viable Feature) from scratch in 2 days — A pollution packed journey starting from doing an assignment to leaving that assignment and going through intense research and analysis to re-designing Snapcash for Generation-Z (Age: 13–18) to enable money transfers via SnapChat Money, based on rational hypothesis & modern design thinking.

Disclaimer

The proposed feature is in no way an official feature rolled out by Snapchat; the work is being done solely as a student learning design.

While designing for the task, I did not intend to mar Snapchat’s online image. Apart from that, this is not being done for any kind of business, technological, or another resource-based benefit. I’ve tried to follow each and every guideline issued by Snapchat for whenever their design elements are being used. No copyright infringement is intended.

The Task

Imagine, you were recently hired in the Snapchat Design team. The team plans to release a new feature “SnapChat Money” in the current Snapchat app for India. They will introduce a wallet (not UPI) into which money can be added from external sources (Debit card/Credit Card/UPI/Net Banking) and then can be used for intra-Snapchat transfers,i.e., Snapchat Money can be transferred between Snapchat users and you have been appointed to lead and execute the entire design.

The discovery of Snapcash

After reading the task, it struck me that this is something Snapchat would’ve also considered, and so to satisfy my curiosity, I googled. I was shocked to see that Snapchat in 2015 had already introduced such a feature, Snapcash, which did exactly as intended but was scrapped due to its misuse! People were to enter their debit card linked with Square, then just type say $5 and send the message to the recipient & Voila! Here’s a video that explains Snapcash quite well →

(Snapcash Explained)

Even though I see it as a strategic move by Snapchat to enter the payment market and take advantage of its humongous user base, the feature “ended up as a way to pay adult performers for private content over Snapchat, not just a way to split bills with friends.” ~ (Josh, TechCrunch)

I think even Snapchat didn’t expect their medium to be used for such purposes; hence they had to put an end to their feature. While this doesn’t give out much about Gen-Z, this was insightful as this helped me base my assumptions before I ended up designing something that’d allow such use of the medium. It also helps me prove that this is a potential area to work for and gives the idea of how such a feature was to be designed while maintaining the uniqueness of Snapchat in it.

Problem Statement

Sometimes motivation is all you need. Upon searching the `famous product designer quotes,` this stood out, “The only important thing about design is how it relates to people.” ~ Victor Papanek. Well, now was the time to talk to a Gen-Z who use(s/d) Snapchat, understand how do they conduct their payment activities, the problems they face in the process, listen to some mishappenings (if you will), and what features/services/elements they liked about specific payment applications. At last, some insight into their Snapchat usage is deemed sensible.

User Analysis

Being a junior at a university, sometimes you are nothing but serious (Wait for it), I asked one of my friends if they would Snapchat for money, and the instant reply that I got “If I were this serious, I’d not rather use Snapchat in the first place.” But considering that my friend aka a 20-year-old boy, didn’t belong to the targeted Gen-Z (13–18 years) users :P, I decided to settle with the observation that the payment activity needed to have a fun component to be perceived as a Snapchat feature and not an entirely different product.

To understand the usefulness of such a feature, as already said, I needed to understand the usage of Snapchat among 13–18 years old and their payment activities. So, I did two telephonic interviews with my younger cousins (Listen to the recordings here) I focused on the following set of questions:

- Have you ever performed an electronic payment? (If the answer to the above question was yes, it was followed up by questions below, otherwise I intended to learn about the reasons that kept them from doing the same)

- If yes, which medium did you use, and why?

- On average, what’s the amount you pay/request per transaction?

- Has there been an incident where something unexpected happened while performing a payment? Say you ever sent someone money by accident instead of requesting money from them or vice versa!?

- How often do you use Snapchat?

- What’s the primary reason you use Snapchat for?

Insights

As someone who has not used a smartphone till class 11th, it was nice to see that Gen-Z is becoming aware & taking up the responsibility at an early stage of life. After having those two calls, here are my learnings of their experiences of conducting payment activities:

- Pain Point #1: Unexpected behavior of the transaction — the user is faced with confusion and couldn’t make sense of what happened when a transaction gets paid successfully & refunded and is not received at the other end as well! And to now make sense of what has happened, there is no initiative from the system to detect such a fault, rather the support of the company X has to be contacted.

- Observation #1: — Though this is a very minute observation, the user assumed PhonePe & Paytm to be the reliable sources of conducting payment activities as they were famous & were already present in their system. This might also define the usability of Snapchat Money as it’d add to the users’ subconscious mind that as they rely on Snapchat to share their moments with others, paying via Snapchat would be reliable too.

Edge Cases

The picture is clear now. But what about edge cases? Though easy to think, documentation is essential, and thus, here goes:

- Users trying to transfer money but with insufficient funds — Requires addition of money to the wallet via external sources(Debit card/Credit Card/UPI/Net Banking)

- Users lose access to the internet while processing transaction — As the default behavior of transaction is, an incomplete transaction would result in no deduction of Snapchat Money between Sender(s) & Receiver(s)

- A user transferred the money while the system fails to acknowledge it at the other end.

- While adding money to the wallet from the bank, while it shows a deduction of the amount from the bank, the money doesn’t show up in the wallet.

Security Concerns

While this seems something to be on the implementation part, it is essential to keep the user feel safe by using the native elements of the application itself. Apart from verifying the Gen-Z users via Aadhar Card, it becomes necessary to have a Security PIN be entered for each and every Intra-Snapchat Transfer to keep users feel satisfied & safe that their security is the primary concern.

The Solution

The following solution is based on the following assumptions:

- My cousins didn’t lie xD

- Users are comfortable using Snapchat

- Users don’t intend to misuse such a service

- Users aren’t in haste to skip the instructions before using the service

- Users do own at least an external source of money (Debit card/Credit Card/UPI/Net Banking)

- The user is an Indian

- The user has viable access to the internet

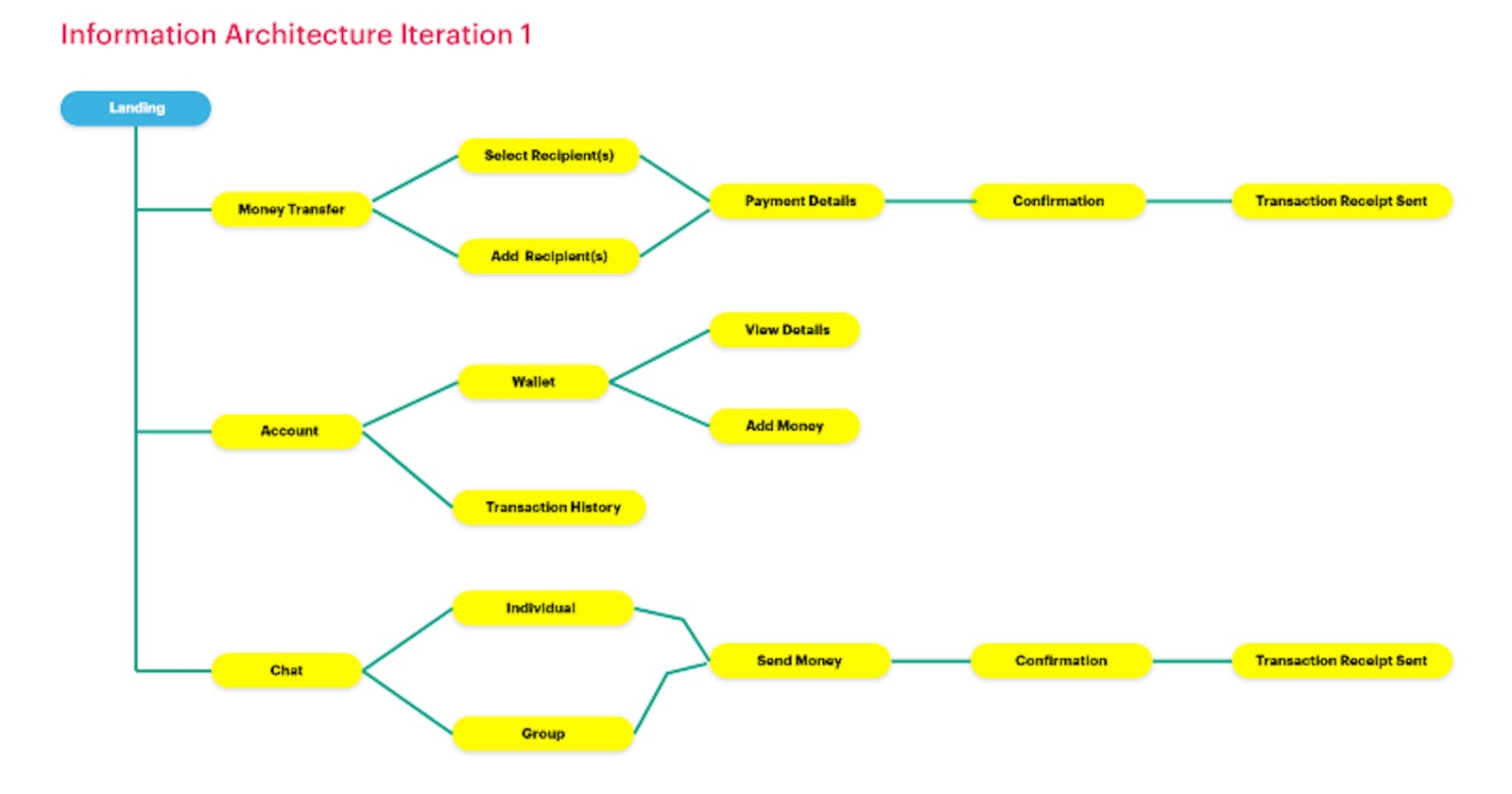

(Information Architecture 1st Iteration | Snapchat Money)

The following was my first iteration over Information Architecture, where I intuitively created the organization, but this seemed to be an overkill for `Simplifying money transfers` so after putting some serious thought into it, I came up with the following:

(Information Architecture 2nd Iteration | Snapchat Money)

The second iteration is better as it actually simplifies the flow. The user(s) either pays/requests to/from a specific user(s) by chat, or switch to the account section, access their wallet, and proceed with their money pay/request or view their transaction history.

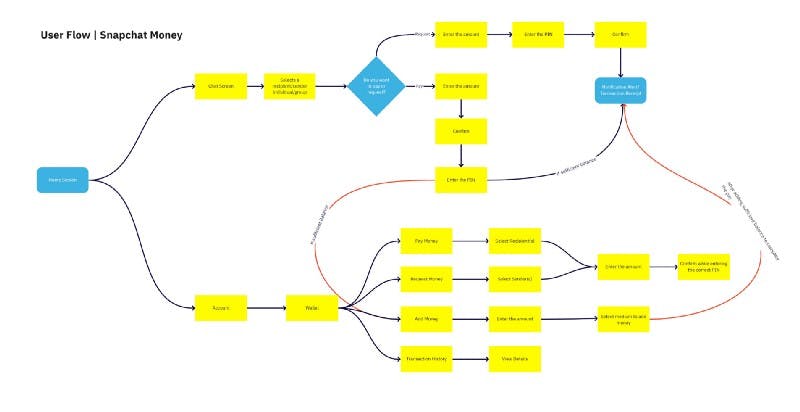

Considering all the edge cases, this is the user flow (view on Miro) I came up with →

Wireframe Sketches

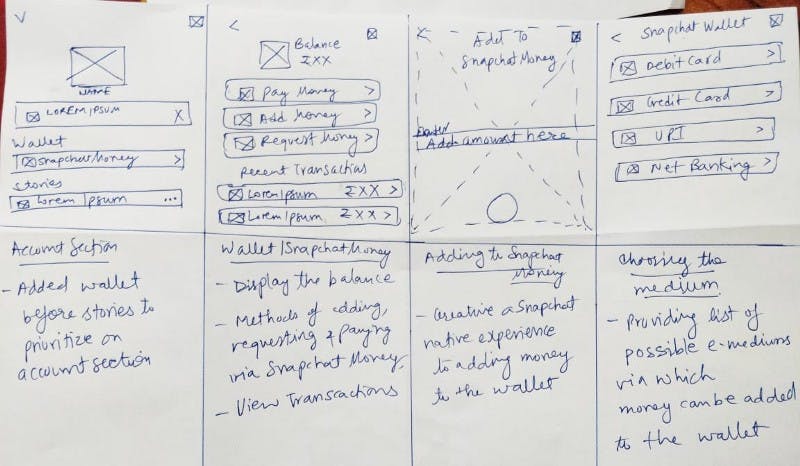

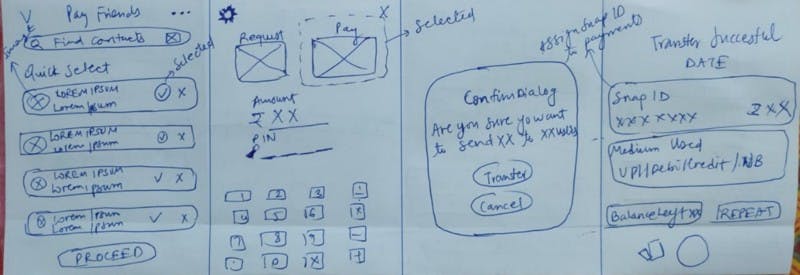

Low Fidelity

Though I’m still developing my drawing skills, here the low fidelity represents a simple scenario where the user intends to make a payment after adding money to the wallet.

(Step 1: Adding money to Snapchat Wallet)

(Step 2: Paying money to friends via Snapchat Wallet)

Tada… Introducing Snapchat Money!

(Snapchat Money, Promotional Banner) [Background courtesy Snapchat Support]

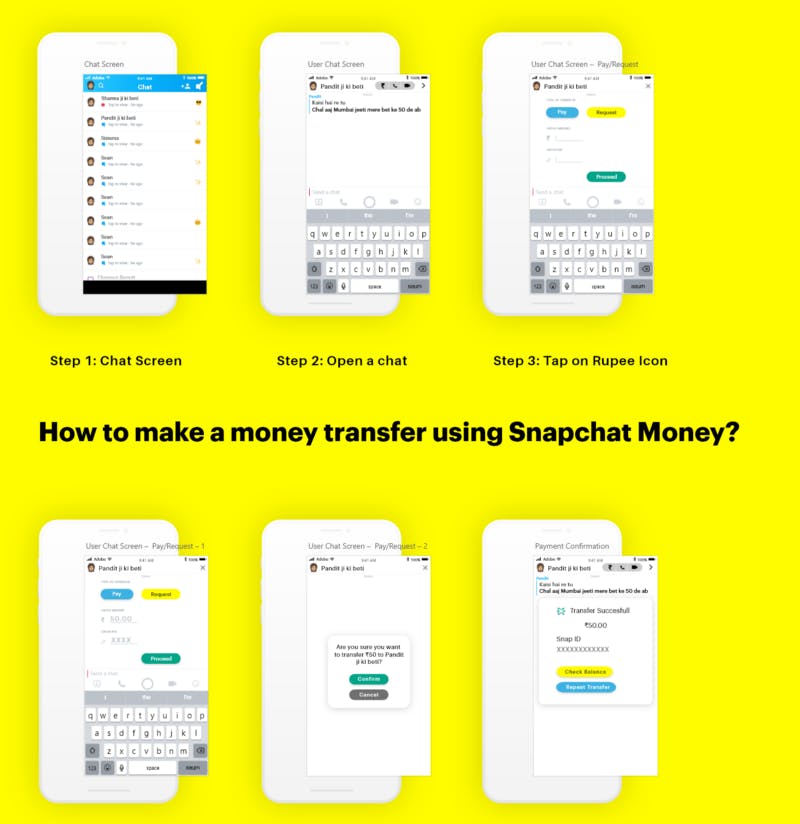

(Money Transfers Via Snapchat Money)

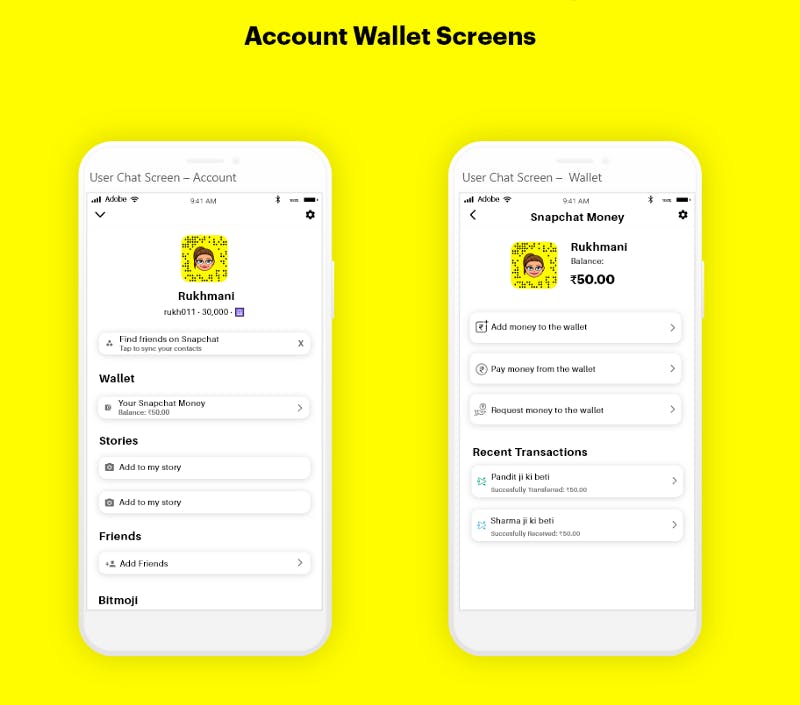

(Account, Wallet Screens — Snapchat Money)

Conclusion

Another fun project! I felt this was a quite realistic problem and needs to be researched. Also while solving I worked with that one task, I chose in my mind, so the design may be a bit biased towards this one workflow, which may cause issues during the actual design and development of the product. Also, the article is a bit heavy on text, so if you have made it this far… I appreciate your patience. Thanks for reading :)

References

- https://medium.com/usabilitygeek/240-hours-of-ux-nutanix-design-competition-f3a98123ccdb

- https://uxdesign.cc/ux-case-study-venmos-pay-request-money-feature-b3499952e41e

- https://www.snap.com/en-US/news/post/introducing-snapcash

- https://techcrunch.com/2018/07/22/snapcashing-out/

- https://uxplanet.org/information-architecture-basics-for-designers-b5d43df62e20